Nvidia-Run:ai deal to be reviewed under EU’s merger rules

- November 4, 2024

- Posted by: chuckb

- Category: TC Artificial Intelligence

Nvidia’s planned acquisition of Israeli AI startup Run:ai, announced in April with a valuation of $700 million, has encountered regulatory hurdles in the European Union (EU). The acquisition will undergo scrutiny following Italy’s competition regulators’ referral to the EU under the EU Merger Regulation (EUMR). As per the regulation, Nvidia must notify the EU Commission before proceeding, which will delay the merger process, potentially by several weeks. If early assessments reveal significant concerns, a more thorough investigation could lead to prolonged uncertainty.

Despite the transaction not meeting the EUMR’s standard notification criteria, EU law empowers national regulators to refer deals they believe may jeopardize competition within their jurisdiction and the broader Single Market. Italy invoked Article 22(1) of the EUMR, suggesting the merger poses a serious competitive threat, thus prompting EU oversight.

The referral’s acceptance indicates that the EU considers the acquisition pertinent enough to examine. The Commission determined that the merger could significantly impact competition not just in Italy, but also across the European Economic Area. TNTa preliminary investigation will require Nvidia to furnish documentation delineating the merger’s particulars, enabling the EU to assess its implications.

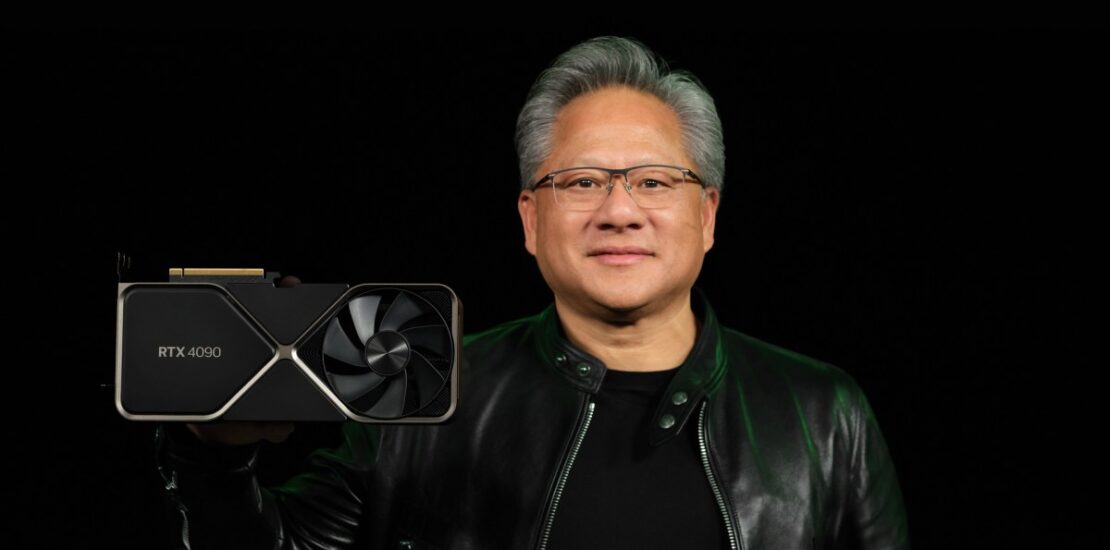

The context around big tech mergers has shifted in recent years, with regulators stepping up their efforts to monitor and assess the competitive impact of acquisitions, especially in rapidly evolving sectors like AI. Nvidia’s dominance in the market for graphics processing units (GPUs), crucial for training AI models, has intensified scrutiny from antitrust authorities, reflecting a broader concern over market concentration and its implications for innovation and competition.

Nvidia’s spokesperson, John Rizzo, expressed the company’s willingness to cooperate with regulators during the review process. He reiterated Nvidia’s commitment to making AI accessible across diverse platforms after the acquisition, highlighting their intent to support customers in selecting optimal systems and solutions.

The evolving regulatory landscape signals increased vigilance from authorities regarding the competitive practices of technology giants, especially as they acquire smaller firms that drive innovation. As Nvidia navigates this regulatory process, the outcome of the Commission’s review will be closely watched, both for its immediate implications and its potential effects on future tech mergers and acquisitions within the EU.